With the recent and prolonged market volatility and economic uncertainty, the demand for financial advice is at an all-time high. And when markets are unpredictable, as they have been in recent years, that’s when investors most often seek financial advice to cope, according to a Cerulli report.

The report confirms that we’ve experienced three cycles of volatility throughout the last decade, and that in every year following the volatility, there’s been a spike in demand for advisor guidance. As further proof of the need for guidance from a trusted financial professional, in 2021, investors who traditionally self-directed their investments reported reaching out for advice for the first time.

Believe it or not, volatility is something that can be embraced – not feared – with a long-term investment horizon.

Below are five reassuring facts around market that may help you keep your eyes on the horizon, weather the storm, and come out the other side stronger for it.

Here are 5 reassuring facts around market volatility:

1.) Volatility may be uncomfortable … but it’s normal.

Just like muscle fatigue is part of any intense training program, volatility is an unavoidable part of the investment process as well. It’s easy to forget that volatility is the norm, not the exception, when stock prices steadily rise or fluctuate less than 1% per day.

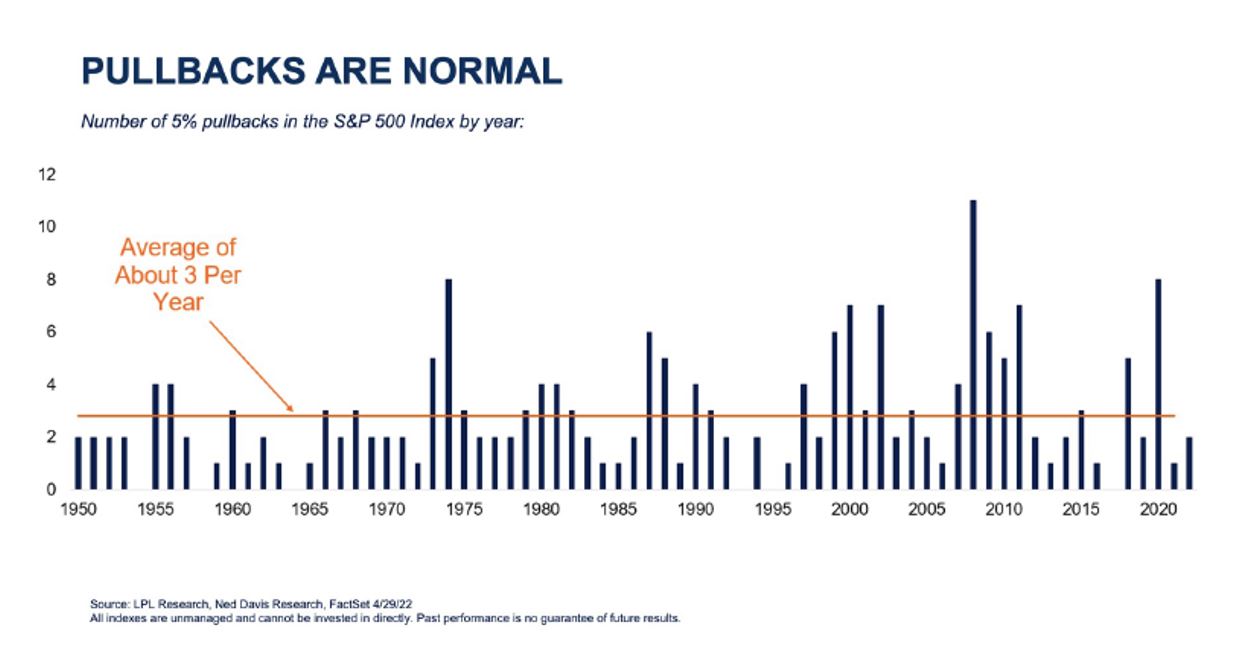

According to market data, stocks have averaged three pullbacks of 5 – 10% per year, and since 1980 the S&P 500 experienced 25 corrections of more than 10%, and it has historically recovered. In addition to understanding the regularity of dips throughout a decades-long investment experience, it’s equally important to emphasize what typically happens in the period following a dip. According to Ned Davis Research, the average return from the lows after a correction exceeds 23% over the next year, something to consider when seeing your account values drop. [Figure 1]

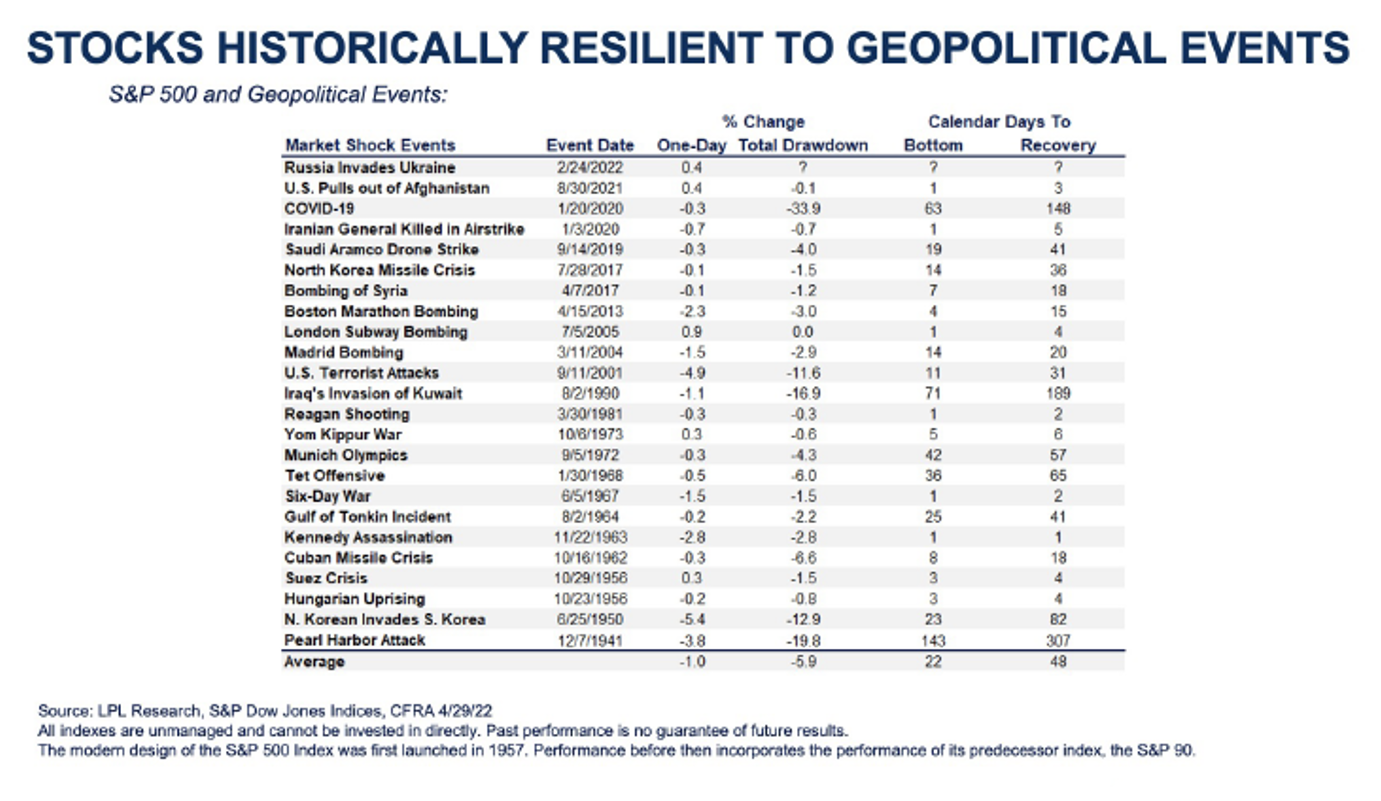

Additionally, we’re living in extraordinary times and while we haven’t faced these exact economic and geopolitical issues before, the market has faced others and eventually, the turbulence ended positively. While it’s never pleasant to watch stock prices fall, it as an expected part of the investment journey [Figure 2]

2.) Patient Investors are Typically Rewarded

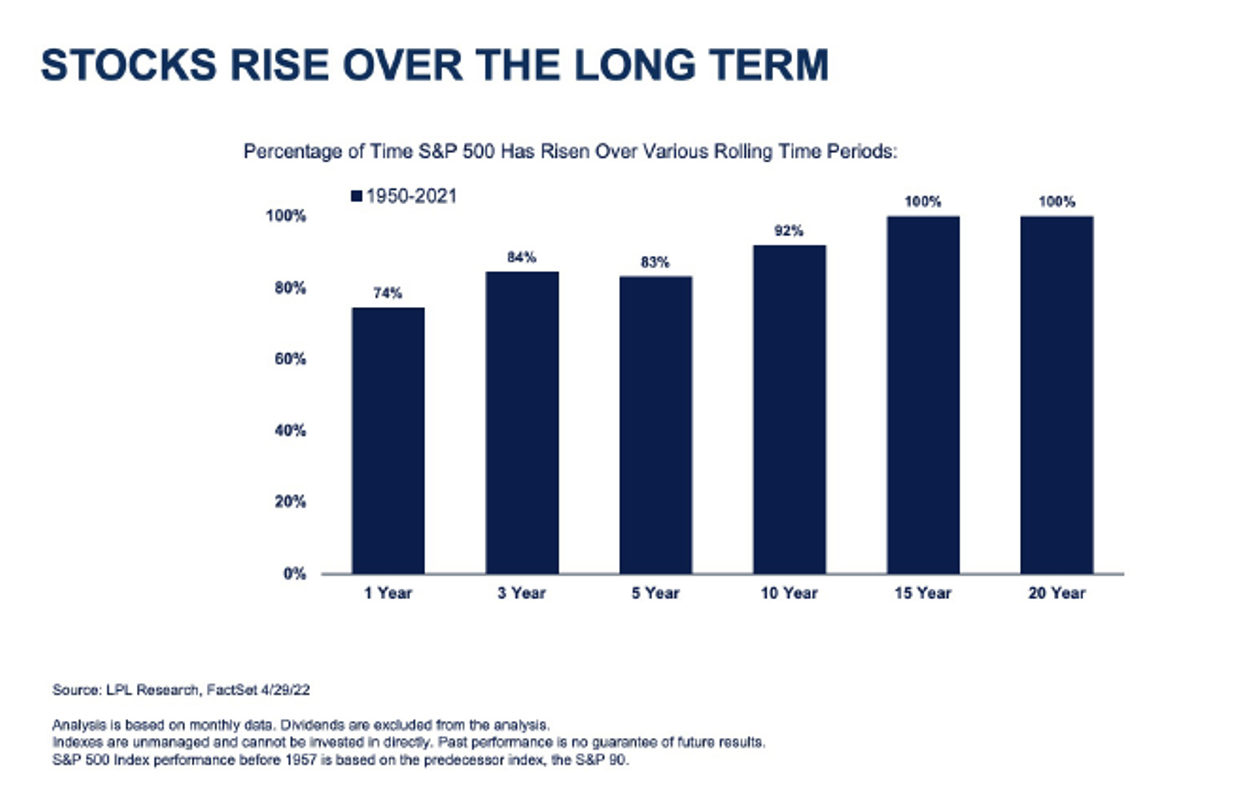

Since 1990, the Dow Jones Industrial Average has achieved 9.5% annualized gains, including dividends. Even if you were to look at shorter time horizons since 1950 the S&P 500 has risen 83% of the time across a five-year horizon, 92% across 10-year periods, and 100% of all rolling 15-year periods. [Figure 3]

And while history cannot guarantee future performance, it can provide insight into the cost of prematurely exiting the market:

From 1990 to 2020, the S&P 500 Index’s annualized gain was 7.5% but the average equity investor’s return was only 2.9%. Why the 4.6% gap in performance? Because when stock prices begin to fall, some investors become driven by fear, which drives them to sell even though it may not be in their best interest.

In addition to understanding the long-term historical perspective, it’s important to be aware of your time horizon. Once you’ve established a long-term goal, your journey to pursue that goal begins. And although the journey may not always be pleasant, there are no shortcuts that allow you to skip over rough terrain.

3.) Timing the Market Doesn’t Work

As an investor, you are naturally inclined to protect your portfolio from additional losses by selling on the slide and re-entering when you feel it’s a safe time to reinvest. And though it may seem tempting to time the market this way, it’s usually a costly mistake.

Even the most seasoned investor can’t predict when a stock has reached its peak or its bottom. During a market decline, if an investor sells out of fear of losing more, the decision of when to re-enter will be equally challenging because re-entering at the wrong time locks in the losses.

Consider this From 1990 to 2020, the market’s largest gains (and losses) occurred within days of each other. Despite “bad” markets, good days are more common than one might think. For example, consider geopolitical events. Stocks typically rise after negative geopolitical events occur, contrary to what most investors believe. Investors moving to cash on those days risk missing out on some of the market’s best days as stocks “climb the wall of worry,” as the old stock market adage goes.

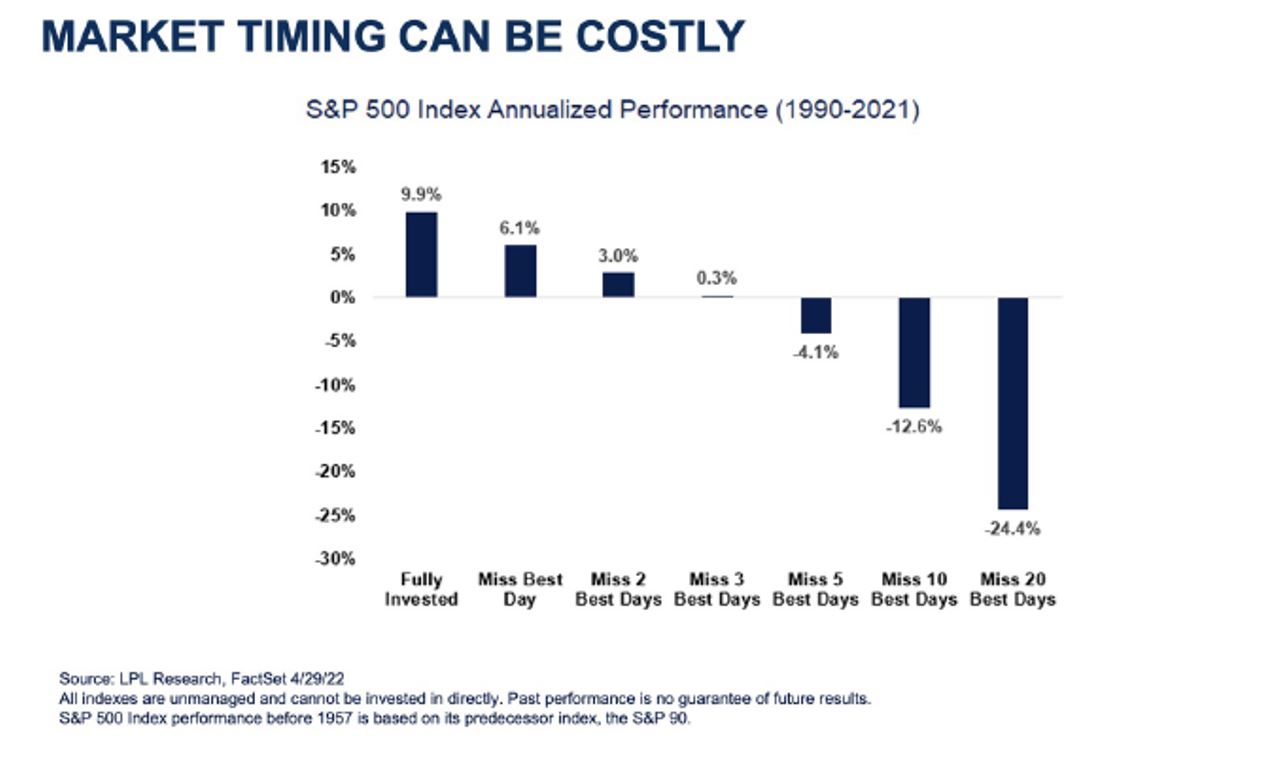

For example, the annualized gain for the S&P 500 from 1990 to 2021 was 9.9%. Yet, if the investor missed only the best day of each year, that annualized return dropped to 6.1%, a difference of 3.8%. If they missed the best two days of each year, they would be up less than 3% annually. Taking it to the extreme, if you missed the best 20 days of each year, they would be down 24.4% per year. [Figure 4]

4.) Opportunities are Everywhere During Volatility

When stocks decline, there is opportunity as an investor to buy in at a lower price and position yourself for future gains. When the decline is part of an overall cycle, stocks trade below their intrinsic values and offer an improved price-to-earnings ratio.

When seen as an opportunity to buy valuable assets at fire-sale prices (when the market is down, investors can get more for their money on individual stocks and equities), you can begin to reframe your experience and think of it from both the buying and selling angles. Selling may cause you to lose capital or to miss out on days where the market makes and holds on to its gains, whereas buying could position the investor better for long-term success.

5.) Dollar-Cost Averaging (And Other Strategies) Can Smooth the Experience

As you may know if you have experience investing in a 401(k), dollar-cost averaging can potentially reduce the overall impact of price volatility and lower the cost per share. While not as thrilling as receiving big gains over a short time, dollar-cost averaging can help investors maintain discipline during downward cycles.

Contributing the same amount of money into the same position on a regular basis, regardless of how the market is performing, is the opposite of trying to get in and out at the “right” time. As a result, dollar-cost averaging can be an effective and reassuring strategy for those who want to invest despite uncertainty. This can provide a smoother investment journey, and help keep long-term goals in focus.