Historically, there are two key general takeaways from midterms: 1) Markets like them to be over and 2) Markets prefer mixed government. The first one is just a matter of time passing. The second is in play if Republicans take the House, independent of what happens in the Senate.

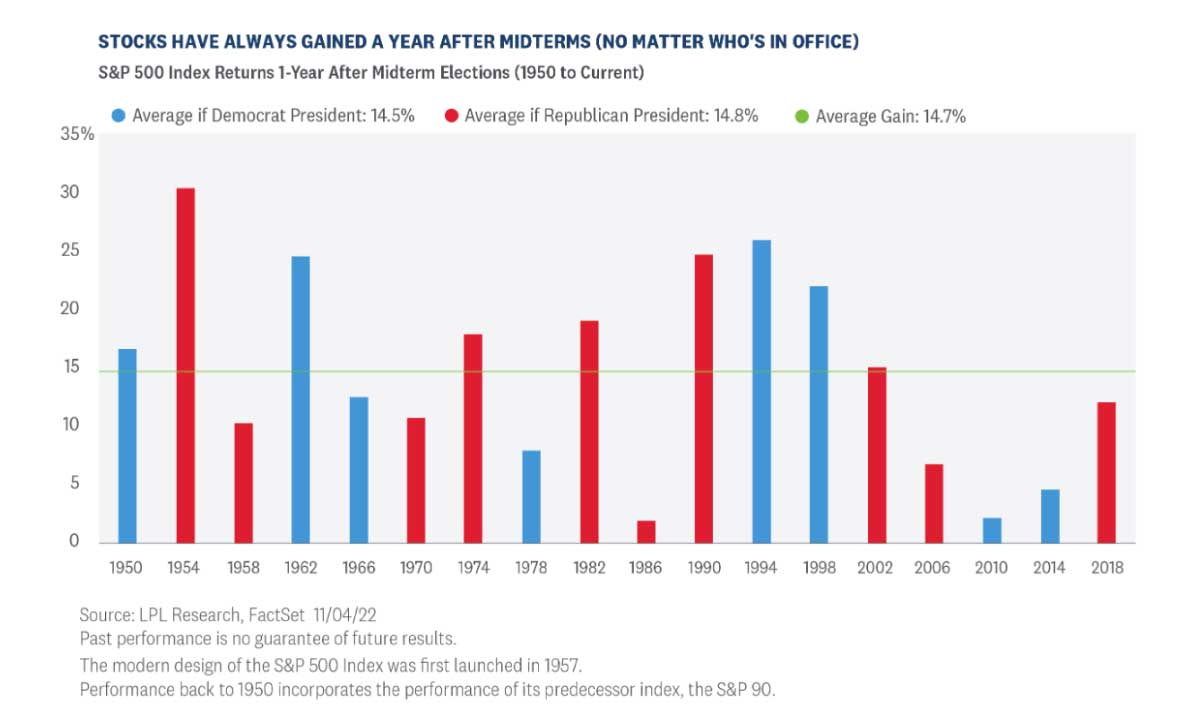

Markets historically have done well in the year after midterms.

In fact, they have been higher 18 out of 18 times in the following year dating back to 1950, with nearly identical historical returns under Democratic and Republican presidents. This is no guarantee that it will happen this time, of course, and remember, the S&P 500 has been higher about 80% of all years over that span, so 18 out of 18 is only somewhat above expectations. Still, there are a few possible fundamental reasons for market strength following midterm elections. Primarily, the uncertainty associated with the election is behind us, and markets don’t like uncertainty. But on top of that, midterms usually provide something of a course correction from presidential elections, as discussed above, and markets may anticipate prospects of a better policy balance ahead, regardless of who is in the Oval Office.

When it comes to mixed government and markets, the historical data has been strong, although there’s still a fair amount of variation depending on individual circumstances. Going back to 1951, a Democratic president with a Republican or split congress, the two most likely cases this election, has seen an average S&P 500 Index return of over 17% versus an overall average of just over 12%. A split congress and a Republican president has also seen strong returns. The major exception to a mixed government working has been a Republican president and a Democratic Congress, which we saw for most of Eisenhower’s administration, as well as under Nixon and Ford, but that’s not a combination we’re currently facing.

Policy Changes Will Be More About What Doesn’t Get Done

Outside of a mixed government and simply getting the election behind us,, we don’t expect many policy changes that might incrementally affect markets coming out of the election, even if Republicans win both the House and the Senate. Policy itself can be difficult to forecast, and economic factors often overwhelm the impact on markets. For instance, the Trump administration was friendlier to energy sector profits than the Biden administration, but the sector’s stock performance stumbled under Trump and has soared under Biden. The policy implications were correct, but more important performance drivers were in play. Nevertheless, there will be some things to watch for:

- Perhaps the biggest policy implication is simply that it will be harder to pass any legislation if we have a mixed government. This would take any meaningful risk of tax increases on households or businesses off the table.

- There is typically incremental improvement to the policy environment for financials, energy, and defense when Republicans hold more power and incremental improvement for healthcare under Democrats. But as seen in the energy example above, larger economic forces tend to be more meaningful.

- The path to raising the debt ceiling may become more difficult, and markets have usually reacted negatively when it starts to look possible that the U.S. will default on its debt.

- The policy environment may be somewhat friendlier to mergers and acquisitions.

- A recession may be incrementally deeper, if we have one, due to a smaller fiscal response.

Conclusion

We expect the impact of the election to tilt the market positive, partly because we’ll have it behind us. Markets have also tended to favor mixed government, especially Democratic presidents with Republican or split Congress, which is our most likely outcome. As far as markets are concerned, the policy impact is likely to be small, and market participants will continue to be more focused on central bank policy and inflation.